Friday, December 09, 2005

Charleston User Fee Controversy Highlights Need for Local Tax Options

Last week, the state Supreme Court upheld the constitutionality of Charleston's $1 per week "user fee" charged to all people employed within the city. The fee, imposed by Charleston to pay for street maintenance and hiring additional police officers, followed similar fees in Huntington and Weirton.

I believe this was a legally sound decision but the fee is unwise as a policy matter. In defense of the 3 cities with these fees, the Legislature has strangled West Virginia's county and municipal governments and centralized public finances to a greater degree than any other state.

The decision of local taxing powers lies within the Legislature. Fundamentally, legislative oversight of and restrictions on subjects of local taxation are appropriate to prevent grossly unfair local tax policies--such as unduly shifting the tax burden onto nonresidents who have no vote--but this protection from abuse has itself been abused. The predominant source of local revenues are local property taxes. Virtually any major local project in this state requires significant state and federal aid.

In its quest to claim a false cover of being anti-tax and to create in local officials constituencies dependent upon local legislative delegations for funding local projects, the Legislature has denied county and municipal governments the ability to raise revenue. Thus, local officials constantly try to win & retain the favor of the local legislative delegation and congressman. In essence, incumbent legislators & congressmen have a key constituency in their local governments because of this relationship of dependency.

In West Virginia, the overwhelming majority of local property taxes go to schools and overall levies are constitutionally capped. Municipalities are allowed to impose business & occupation taxes (effectively gross receipts taxes) on local businesses. Per dollar of property taxes paid on property located within municipalities, the municipality gets only 8 cents. The B&O taxes are terribly unfair to businesses and bear no proportionality to profitability or other reasonable basis for taxing a business. Some towns--most notably Summersville--have turned their police departments into lean, mean ticket-writing machines that fleece unlucky motorists. The constitutional cap on levy rates is the only good policy of the bunch.

Unlike many other states, West Virginia counties & municipalities cannot levy income, sales, or other common local taxes. A law passed in 2004 and originally scheduled to take effect this year--since delayed to 2008--would allow a 1% municipal sales tax in municipalities that abolish their B&O taxes. However, even before the delay, every municipality that has a B&O tax reviewed this option and found it unacceptable, though municipalities without B&O taxes are considering the sales tax as a future option.

During its study of West Virginia's tax system in the late 1990's, the Commission on Fair Taxation--chaired by then Tax & Revenue Secretary Rob Capehart, now the Chairman of the West Virginia Republican Party--included local taxation within the scope of its study. The major changes proposed to local taxation included the abolition of personal property taxes, the reallocation of real property taxes from schools (which would be funded from state funds) to the counties & municipalities, and allowing local sales & income taxes. The Commission stated:

Local governments in West Virginia are hamstrung by Constitutional and legal restrictions, which result in counties and cities having less fiscal flexibility than in any other state. The maximum property tax levies are set in the State Constitution and reflect the fears of the Depression when homes, farms and businesses were being sold for back taxes. Unlike boards of education, municipalities and counties must gain a super majority to pass bond issues. Municipalities may impose a B&O tax, which the State repealed for most businesses effective July 1, 1987. But use of this tax drives businesses to locate just outside city boundaries.

Other states allow for their local governments to "piggyback" onto state levies. This can be done by permitting local entities to share a state tax. Under this system, the state collects the taxes for the locality and remits the funds collected after the subtraction of appropriate administrative expenses. Usually the additional rate the local government can use is set in state law and the city or county must use the state base. The piggyback approach reduces local government compliance costs and the uniform use of the tax base likewise keeps state and taxpayer compliance costs down.

The Commission has, therefore, recommended that counties and cities be given the authority to piggyback onto two State taxes -- the progressive income tax and the general excise tax. The Commission recognized that each of these State taxes might have a different appeal to various localities, depending on their location and income base. Municipalities would have the option to use one or both of these two taxes or retain their B&O tax. In all cases, voter approval would be required before either or both of the piggyback taxes could be imposed.

Standing alone, the recommendation of the Commission to eliminate the property tax on tangible personal property could present serious fiscal problems for local governments because it would reduce the local property tax base by more than half in some counties and in many cities. Without an alternative source of revenue, it would be impossible for local governments to maintain current levels of services.

Since the Commission has proposed elimination of the school property tax, that levy authority would be available to cover much of the loss of personal property tax revenues, without there being any increase in overall taxes on real property. The Commission is proposing that local governments be allowed to use up to 90 percent of the school levy on real property. The remaining 10 percent of the abandoned school levy on real property would be used by the State for equalization of education funding. This proposal is further explained in Chapter Three, Section IX of this report.

If the portion of the abandoned school levy on real property did not prove sufficient to replace the lost personal property taxes in a county or city, then the Commission proposes establishing a replacement fund which will consist of 50 percent of the taxes on centrally assessed real property of public service corporations (electric and gas companies, railroads, airlines, water companies, etc.). In addition, this fund would include 2.325 percent of the State's share of the regular severance tax on coal. Since most of the counties which would need replacement money are either heavy coal producing counties or have significant electrical generation plants, the plan returns taxes based on their origin.

I believe the proposal by the Commission on Fair Taxation is a very responsible approach to both state and local taxation. In fact, I would probably go beyond that proposal relative to local taxes and abolish municipal B&O taxes and the "user fees" 3 cities impose on people employed in those cities. They 2 main keys to any expansion of local taxing authority are (1) establishing a fair tax base and (2) establishing effective accountability to voters and taxpayers. West Virginia's counties & municipalities need options other than groveling before the local legislative delegation, hat in hand.

Thursday, December 08, 2005

10 Years Ago Today: End of the Road for the National Maximum Speed Limit

Ten years ago today, the National Maximum Speed Limit--a federal law that limited the top speed limit to 55 miles per hour on all highways from 1974 to 1987 and 65 on rural interstates and 55 on all other highways from 1987 to 1995--came to an end. The then-infant Republican majority in Congress repealed the most ignored federal law since Prohibition and returned to the states the power to set all highway speed limits and determine enforcement levels.

Ten years ago today, the National Maximum Speed Limit--a federal law that limited the top speed limit to 55 miles per hour on all highways from 1974 to 1987 and 65 on rural interstates and 55 on all other highways from 1987 to 1995--came to an end. The then-infant Republican majority in Congress repealed the most ignored federal law since Prohibition and returned to the states the power to set all highway speed limits and determine enforcement levels.

Our thanks for this achievement belong with the National Motorists Association, a national motorists' rights organization founded in 1982 with an initial purpose of repealing the NMSL. Today, the NMA continues its advocacy for "reasonable speed limits, better driver training, improved motorist-to-motorist courtesy, and sensible, easily understood regulations." The NMA issued the following announcement to commemorate this anniversary:

Madison, Wisconsin, December 6, 2005 -- Motorists across the nation can celebrate the Tenth Anniversary of the repeal of the National Maximum Speed Limit (NMSL) by driving at safe, legal speeds well above 55 mph. National legislation repealing the decades-old NMSL was signed into law on December 8, 1995.

The NMSL, a product of the Nixon administration, was implemented in response to the OPEC oil embargo. After the embargo was lifted, a coalition of groups appeared in support of the lower limit as a "life-saving measure." It was because of such arguments that Congress passed legislation making the 55-mph National Maximum Speed Limit permanent in 1975.

The Citizens Coalition for Rational Traffic Laws (CCRTL), which later became the National Motorists Association (NMA), was founded seven years later for the express purpose of repealing the NMSL. As public compliance shrank, Congressional supporters of the NMSL authorized a National Academy of Science study to document the benefits of the national limit. This study radically altered the dynamics of the public's discussion of the limit.

The NMA demanded that costs, as well as benefits, be part of any evaluation of this law. The debate was dragged into the public and political arenas and the support and rationalizations for the 55-mph NMSL started to show serious flaws. Claims of lives saved were proven largely invalid. The fact that non-compliance was much greater than the government was admitting also came to light. Public opinion began to shift, and it became socially and politically acceptable to at least talk about higher speed limits.

During this discourse, the NMA became the clear primary opponent of the NMSL. Our organization encouraged sympathetic members of Congress to help us undo the damage of 55-mph limit. Ultimately, in 1987, despite predictions of thousands of additional highway fatalities, Congress decided to allow states to raise Interstate and expressway speed limits to 65 mph.

By the early 1990s, these doom and gloom scenarios were proven false. All but a few states had opted to raise their speed limits, while fatality rates declined nationwide. Following this limited victory, the NMA continued to push for a full repeal of the NMSL. Through a little serendipity and a lot of hard work, Congress passed and President Clinton signed legislation that included a provision repealing the NMSL in its entirety.

Again, opponents of the repeal claimed that without a national speed limit fatalities would increase by over 6,000 victims in the first year alone. Instead, many states raised limits to 70 or 75 mph, expanded 65-mph speed limits to other roads, and the number of fatalities actually declined. During the past ten years since that time, the fatality rate has continued to decline, despite higher speed limits and higher driving speeds. This clearly demonstrated that the 22-year-long experiment with an arbitrary national speed limit served no positive purpose. It wasted time, resources, and billions of dollars while neither reducing fuel consumption nor improving highway safety.

The National Motorists Association was established in 1982 to represent the interests and rights of North American motorists. It is a grassroots organization that operates at the national level and through a system of state chapters. It continues to advocate safe and reasonable speed limits set in accordance with traffic engineering standards, not arbitrary political whim. The NMA is entirely supported through the contributions of individuals, families, and small businesses.

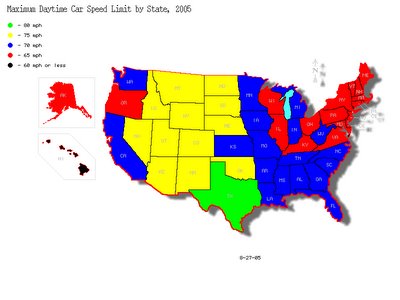

Since 1995, 31 states have raised their top speed limit to 70, 75 or 80 miles per hour. Over this period, the only reduction came in 1999 when Montana imposed a 75 mph speed limit. North Dakota and Texas have both had multiple rounds of speed limit increases. Colorado and Texas are developing new toll roads (the Front Range Toll Road and the Trans-Texas Corridors) that will feature 85 mph speed limits when constructed over the next decade.

Green=80 mph; Yellow=75 mph; Blue=70 mph; Red=65 mph; Black =60 mph

Green=80 mph; Yellow=75 mph; Blue=70 mph; Red=65 mph; Black =60 mph

Overall, however, speed limits are generally where they were 35 years ago despite light years of progress in automobile and highway design. Regardless of posted limits or enforcement practices, prevailing traffic speeds in most parts of the country tend to be 75-80 mph on rural freeways, 65-75 on four-lane highways with uncontrolled access, and 60-65 on primary rural 2-lane highways.

The profession of traffic engineering has determined appropriate methods for speed zoning. The NMA has developed a catalogue of state DOT policies, which most often are not followed. According to the West Virginia Department of Transportation:

"There is a common belief among laymen and even some elected officials that traffic speeds can be lowered by merely posting signs. This is not true. Artificially low speed limits invite violations by responsible drivers. Enforcement of unrealistically low speed limits sets up a Âspeed trap which is poor public relations and causes a loss of respect for traffic law enforcement activities in general.

"The nationally accepted principle, which is followed by the Division of Highways, is to set the posted speed limit at the speed below which 85% of the vehicles travelingling on the road or street, in the absence of factors which may introduce a special hazard. Experience has shown that at least 85% of motorists drive at a speed which is reasonable and prudent, operating their vehicles at a speed which reflects the character of the roadway and the amount of development along it. The other 15% are those who may be subject to enforcement action."

The United States is well behind many countries in freeway speed zoning. Wikipedia shows that Belgium, Finland, Greece, Ireland, the Netherlands, Portugal, Spain and Switzerland post 120 km/h (75 mph) speed limits on their freeways; Austria, Croatia, the Czech Republic, Denmark, France, Hungary, Poland, Romania, Slovakia, Slovenia, and Turkey are at 130 km/h (80 mph); Italy has adopted a 150 km/h (95 mph) speed limit on its newest Autostradas; and, of course, the Germans can still drive the Autobahn at the speed of their choice and have a fatality rate slightly lower than the U.S. interstate system despite their high speeds.

Roll Call: Mollohan Took $23,000 From Corrupt Defense Contractor That Bribed Former Calif. Congressman

The Capitol Hill newspaper Roll Call reported today that Congressman Alan Mollohan, D-Fairmont, was the recipient of at least $23,000 donated to PACs and foundations under his control from defense contractor MZM and its affiliates. RedState also has a piece on this.

The Capitol Hill newspaper Roll Call reported today that Congressman Alan Mollohan, D-Fairmont, was the recipient of at least $23,000 donated to PACs and foundations under his control from defense contractor MZM and its affiliates. RedState also has a piece on this.

MZM is the defense contractor that paid $2.4 million in bribes to disgraced former Congressman Randy "Duke" Cunningham. Cunningham, R-Calif., pleaded guilty last week to federal conspiracy and tax evasion charges in connection with the bribes and resigned his seat in Congress.

MZM is the defense contractor that paid $2.4 million in bribes to disgraced former Congressman Randy "Duke" Cunningham. Cunningham, R-Calif., pleaded guilty last week to federal conspiracy and tax evasion charges in connection with the bribes and resigned his seat in Congress.

Mollohan is the ranking Democrat on the House Appropriations Committee's Subcommittee on Science, State, Justice, Commerce and Related Agencies and the ranking Democrat on the House Committee on Standards of Official Conduct--commonly known as the Ethics Committee. In these positions, despite being in the minority party, Mollohan wields considerable influence over the appropriations for 3 Cabinet departments and several independent investigations and the oversight of ethics of House members.

Delegate Chris Wakim, R-Wheeling, has already announced his candidacy for Congress next year, challenging Congressman Mollohan. Wakim is a disabled Gulf War veteran, West Point graduate, and owner of several small businesses in the Wheeling area.

Tuesday, December 06, 2005

John Kerry: 34 Years Later, New False Allegations of Barbary Against U.S. Troops

This week, John Kerry--the haughty, French-looking junior senator from Massachusetts who claims few successes beyond marrying wealthy women--lodged war crime accusations against U.S. troops in Iraq bearing little difference from the slandering he delivered his former comrades in 1971.

"They told the stories at times they had personally raped, cut off ears, cut off heads, taped wires from portable telephones to human genitals and turned up the power, cut off limbs, blown up bodies, randomly shot at civilians, razed villages in fashion reminiscent of Jengiss [sic] Khan, shot cattle and dogs for fun, poisoned food stocks, and generally ravaged the countryside of South Vietnam..."

All of this was one big pack of lies. Later, John Kerry would admit he never witnessed or had any other firsthand knowledge of any war crimes committed in Vietnam.

John Kerry, 2005:

John Kerry, 2005:

"I don't agree with that. But I think what we need to do is recognize what we all agree on, which is, you've got to begin to set benchmarks for accomplishment; you've got to begin to transfer authority to the Iraqis, and there is no reason, Bob, that young American soldiers need to be going into the homes of Iraqis in the dead of night, terrorizing kids and children, uh-uh-uh, you know, women, breaking sort of the customs of the -- of -- of -- of -- historical customs, religious customs, whether you like it or not. Iraqis should be doing that. And after all of these two and a half years, with all of the talk of 210,000 people trained, there just is no excuse for not transferring more of that authority."

Thirty-four years have done nothing to John Kerry's truthfulness regarding the conduct of American soldiers in war.

Dean Says U.S. Must Surrender or Face Defeat in Iraq

"The idea that we're going to win the war in Iraq is an idea which is just plain wrong...I've seen this before in my life. This is the same situation we had in Vietnam. Everybody then kept saying, 'just another year, just stay the course, we'll have a victory.' Well, we didn't have a victory, and this policy cost the lives of an additional 25,000 troops because we were too stubborn to recognize what was happening."

This is simply reprehensible. We've known since the 2004 Iowa caucus that Dean is just plain nuts. However, not even this can explain expressing such a desire for snatching defeat from the jaws of victory. We have been fighting two wars in Iraq: a war against the Saddam Hussein regime and the War on Terrorism thanks to the migration of terrorists to Iraq. The war against the Hussein regime was won long ago.

Now, Iraq has become the latest battleground in our worldwide war on terrorism that we entered on September 11, 2001. The terrorists have come to Iraq to fight us. As Senator Joe Lieberman so accurately explained last week, we are in the midst of a war in Iraq between 27 million Iraqis and 10,000 terrorists. Indeed, not only are we fighting the terrorists, but also real criminals that were freed from prison when the Hussein regime fell. Iraq has a population slightly less than California Could anyone imagine the absolute chaos that would result if California completely emptied its jails and prisons?

Now, Iraq has become the latest battleground in our worldwide war on terrorism that we entered on September 11, 2001. The terrorists have come to Iraq to fight us. As Senator Joe Lieberman so accurately explained last week, we are in the midst of a war in Iraq between 27 million Iraqis and 10,000 terrorists. Indeed, not only are we fighting the terrorists, but also real criminals that were freed from prison when the Hussein regime fell. Iraq has a population slightly less than California Could anyone imagine the absolute chaos that would result if California completely emptied its jails and prisons?

We are winning in Iraq. We won the war and now we're winning the reconstruction. In just over 2 years, Iraq has gone from a barbarous dictatorship to a democratic republic that will elect a full-term government in less than a week. We needed several years to establish a democratic German government after World War II and a full decade to democratize Japan.

Click here

Click here