Kiss Joins Helmick in Publicly Opposing Tax Relief, Employs Dishonest Rhetoric About the Need to Pay Debts First

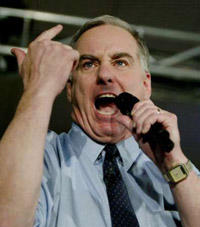

Just after I complained last night of the incredibly slow pace of news, I read in today's Beckley Register-Herald that House of Delegates Speaker Bob Kiss has joined Senate Finance Committee Chairman Walt Helmick in parroting the Ruling Party's legislative leadership party line against proposals to reduce West Virginians' tax burden (article no longer available online).

Just after I complained last night of the incredibly slow pace of news, I read in today's Beckley Register-Herald that House of Delegates Speaker Bob Kiss has joined Senate Finance Committee Chairman Walt Helmick in parroting the Ruling Party's legislative leadership party line against proposals to reduce West Virginians' tax burden (article no longer available online).

For the uninitiated, Kiss is one of those "conservative Democrats" that would like you to think he's a Republican in everything but name and usually comes down on the conservative side of issues when they finally make it to a vote. As any longtime observer of the Legislature knows, although liberal legislation rarely passes, the progress of conservative legislation is severely impeded via the committee process and the placement of liberals in key committee chairmanships (i.e., Delegate Jon Amores at House Judiciary or former Senator Bill Wooton during the decade he chaired Senate Judiciary). When he votes, Kiss has usually been such a reliable conservative vote that former Governor Cecil Underwood attempted to appoint Kiss to the state Supreme Court in 1999. Of course, what other kind of Democrat would manage to stay in office in a county where President Bush won 62% of the vote last year?

Like Walt Helmick, who I discussed Tuesday and Wednesday, Kiss has decided to play a sleight of hand by opposing tax cuts and claiming that we really need to appropriate more money toward reducing the state's debts while also planning to increase spending. They say we don't have the money when tax cuts are proposed but say we do when increasing spending is proposed. The decisive votes that defeated the pension bond in June came from people like me who used their vote to deny the legislature more money to spend; if the bond has passed, the "savings" that would have resulted would have all been redirected to other spending.

The legislative Democratic leadership needs to tell us the truth. Either we have enough money for either more spending or tax cuts or we don't, but there's no way we can have it for the former but not the latter. They really need to revise their talking points to take a consistent line on whether we're really rolling in the money. I suspect that we do have enough money and the people of West Virginia need to debate the question of how to proceed with this money. Sadly, I suspect that the Ruling Party's legislative leadership is playing these games with us because they know they would lose if we West Virginians had the debate over whether we should dispose of the extra anticipated state revenues by increasing spending or cutting taxes. They would not only lose--I suspect they would be blown out of the water and possibly out of power for the first time in over 75 years.

What about the debt payment option? I wouldn't mind using the extra state revenues for debt reduction if the leadership of the Ruling Party would be honest with us and we had stronger controls on state taxes and spending in the state Constitution and if the poorest state in the country wasn't one of the most heavily taxed per dollar of per capita income.

Here are some statistics on how West Virginia compares to other states in state taxes, as of 2004, most of which are courtesy of the Tax Foundation:

- We are one of few states in the country that subjects groceries to the sales tax. Of our 5 neighboring states, only one--Virginia--taxes groceries, and does so at a reduced rate.

- Only nine states have a state sales tax rate higher than our 6%. Many of these states--Nevada, Texas, Tennessee, and Washington state--do not have a personal income tax.

- We are one of few states in the country that subjects residents in poverty to the state income tax--almost every other state with a personal income tax has a personal exemption large enough to exempt people below the federal poverty line from taxation.

- We have a higher top marginal personal income tax rate than 4/5 of our neighboring states--ours is 6.5% compared to 3.07% in PA, 4.75% in MD, 5.75% in VA, 6% in KY, and 7.5% in OH (which is scheduled to be reduced significantly over the next few years).

- We have one of the highest corporate income tax rates in the country at a flat rate of 9%. The only states with a higher rate are Alaska at 9,4% (a state with no personal income tax or sales tax), Iowa at 12%, Massachusetts at 9.5%, Minnesota at 9.8%, New Hampshire at 9.5% (a state with no personal income tax or sales tax), Taxsylvania--er, Pennsylvania--at 9.99%, Vermont at 9.75%, and the People's Republic of Washington, DC, at 9.98%.

- We have an extremely onerous business franchise tax that taxes all businesses, large and small, corporations and otherwise, based on their capital. This tax is a significant impediment to business investment in this state. In fact, since 2001, this tax has raised more revenue than the corporate income tax.

- Although this falls on the spending side, we have a larger state government per capita than 47 other states and all 10 Canadian provinces.

Thanks to state revenues for FY 2005 exceeding estimates by over $400 million, the Legislature eliminated the entire unfunded liability in one of the State Police pension funds. To the extent we can more quickly eliminate the other pension debts, we should. However, the Ruling Party leadership's rhetoric about opposing tax cuts because they want to focus on debt reduction is a pure fraud. Because of our excessive tax burden, the cause of tax relief is even more compelling than additional debt reduction when we're meeting the payments on the existing debt payoff plan and reducing taxes might actually spur additional economic activity that would result in additional tax revenues. Then, if we have surpluses, we should appropriate funds toward additional debt reduction. Creating new spending programs that will need recurring appropriations every year is not the responsible thing to do.

Thanks to state revenues for FY 2005 exceeding estimates by over $400 million, the Legislature eliminated the entire unfunded liability in one of the State Police pension funds. To the extent we can more quickly eliminate the other pension debts, we should. However, the Ruling Party leadership's rhetoric about opposing tax cuts because they want to focus on debt reduction is a pure fraud. Because of our excessive tax burden, the cause of tax relief is even more compelling than additional debt reduction when we're meeting the payments on the existing debt payoff plan and reducing taxes might actually spur additional economic activity that would result in additional tax revenues. Then, if we have surpluses, we should appropriate funds toward additional debt reduction. Creating new spending programs that will need recurring appropriations every year is not the responsible thing to do.

When a member of the Ruling Party's legislative leadership is asked about tax cuts, their recital of the talking points will include the story of the massive tax hikes passed in 1989 (including the food tax and raising the sales tax from 5% to 6%) and how they were caused by irresponsible tax cutting in the past. Nowhere do they mention spending. And if there's concern about the people who actually have to pay these taxes, it sure isn't apparent. The Ruling Party likes to remind us they have since reduced the business franchise tax, exempted families making less than $10,000 a year (about half the federal poverty line for a family of four) from the personal income tax, and repealed the physician provider tax (a 5% gross receipts tax on doctors). The truth is that they passed each of these relatively small tax cuts while kicking and screaming after the deluge of support for these Republican-originated bills.

As I have written before, one of the solutions for our state's seemingly endless cycle of more spending, fiscal crisis, and tax increases, is to adopt a tax and expenditure limit similar to Colorado's Taxpayer Bill of Rights. In the absence of a strong legal restraint on spending, government will naturally grow faster than the desire of the taxpayers to support it. Of course, doing this will require getting the 2/3 vote in both houses of the Legislature necessary to propose a constitutional amendment, which is very unlikely at this point. During the past regular session, a bipartisan group of members of the House of Delegates introduced HJR 20, which would copy Colorado's successful TABOR limit. The Democrats cosponsoring this amendment were Tom Louisos of Fayette County and Jeff Eldridge of Lincoln County (at least on this issue, here's hoping he didn't win election to his office "the old-fashioned way" and thereby put himself in jeopardy of following his term in the House with a term in a federal prison cell). I am working on my own proposal that is similar to this amendment.

For about the last 3 years, a scandal has been slowly unfolding in the ranks of the Pennsylvania State Police over the use of illegal ticket quotas and the increasingly high likelihood that a large number of tickets have been wrongfully issued by officers seeking to meet their quotas.

For about the last 3 years, a scandal has been slowly unfolding in the ranks of the Pennsylvania State Police over the use of illegal ticket quotas and the increasingly high likelihood that a large number of tickets have been wrongfully issued by officers seeking to meet their quotas.

If you believe the somewhat less than luminary minds that occupy the Democratic leadership in the Legislature, West Virginia should not cut taxes until we've paid off the ~$5.5 billion (present value) unfunded liabilities of the state pension funds. This is the same cabal, mind you, that is simultaneously preparing to pass public employee pay raises and maybe other spending programs that will require higher state spending permanently.

If you believe the somewhat less than luminary minds that occupy the Democratic leadership in the Legislature, West Virginia should not cut taxes until we've paid off the ~$5.5 billion (present value) unfunded liabilities of the state pension funds. This is the same cabal, mind you, that is simultaneously preparing to pass public employee pay raises and maybe other spending programs that will require higher state spending permanently. Disgraced former House Education Committee Chairman Jerry Mezzatesta illegally steered hundreds of thousands of dollars of education funds away from more deserving counties to his employer, Hampshire County schools, while collecting paychecks for both jobs simultaneously and despite an agreement with the Ethics Commission stipulating that he would not use his leadership position to steer money to his employer. Mezzatesta was formerly a $60,000 a year grant writer whose job description involved applying for federal and private grants; he wrote no grant applications in his five years in that position although he steered a lot of state funds.

Disgraced former House Education Committee Chairman Jerry Mezzatesta illegally steered hundreds of thousands of dollars of education funds away from more deserving counties to his employer, Hampshire County schools, while collecting paychecks for both jobs simultaneously and despite an agreement with the Ethics Commission stipulating that he would not use his leadership position to steer money to his employer. Mezzatesta was formerly a $60,000 a year grant writer whose job description involved applying for federal and private grants; he wrote no grant applications in his five years in that position although he steered a lot of state funds.

West Virginia Senate Finance Committee Chairman Walt Helmick, who will face a stiff reelection challenge next year in the sprawling

West Virginia Senate Finance Committee Chairman Walt Helmick, who will face a stiff reelection challenge next year in the sprawling  The ugly little secret of the supposedly "conservative" Democrats in the Legislature is that when it comes to fiscal issues, they're chronic taxaholics in denial--and not just any case, but John Kerry/Ted Kennedy/Michael Dukakis-type taxaholic. To them, tax cuts can never happen, because "we don't have the money." The legislative leaders think we work for them and then we serfs get to keep what they let us after they take what they want. It's time to make a run on the pitchforks.

The ugly little secret of the supposedly "conservative" Democrats in the Legislature is that when it comes to fiscal issues, they're chronic taxaholics in denial--and not just any case, but John Kerry/Ted Kennedy/Michael Dukakis-type taxaholic. To them, tax cuts can never happen, because "we don't have the money." The legislative leaders think we work for them and then we serfs get to keep what they let us after they take what they want. It's time to make a run on the pitchforks. This morning, I got an e-mail from the state Republican Party. Fundraising, I thought. No; this time they wanted not money but just my thoughts and those of other Republican activists. The Democrats want to play Let's Make a Deal with our caucus on table games so they can pass the bill and have political cover in next year's elections. The e-mail I received and my response follow. If you agree with me, I hope you'll share your thoughts by e-mailing the state Republican Party at

This morning, I got an e-mail from the state Republican Party. Fundraising, I thought. No; this time they wanted not money but just my thoughts and those of other Republican activists. The Democrats want to play Let's Make a Deal with our caucus on table games so they can pass the bill and have political cover in next year's elections. The e-mail I received and my response follow. If you agree with me, I hope you'll share your thoughts by e-mailing the state Republican Party at